VAT Report in AutoGMS

Track VAT collected and VAT paid with the AutoGMS VAT Report. Monitor output tax, input tax, taxable turnover, and export reports easily.

Accurate VAT tracking is essential for any VAT-registered garage. The VAT Report in AutoGMS provides a structured breakdown of:

- VAT collected from customers (Output VAT)

- VAT paid on purchases (Input VAT)

- Taxable turnover

- Net VAT payable or refundable

Instead of manually reconciling invoices and expenses, AutoGMS automatically calculates everything based on recorded transactions.

You can access it from:

Finance → VAT Report

At the top right, you can:

- Select the reporting period

- Export the report

- Switch between Summary, Tax Collected (Sales), and Tax Paid (Purchases)

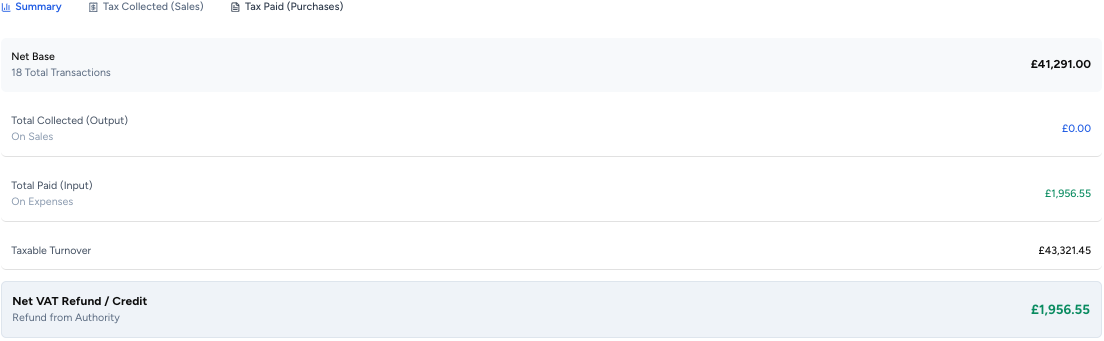

VAT Summary Tab

The Summary tab gives a clear high-level overview of your VAT position for the selected period.

Net Base

Total net value of transactions included in the period.

Total Collected (Output VAT)

VAT charged on customer invoices.

This is calculated from:

- Sales invoices

- Bookings converted to invoices

- Taxable services and parts

Total Paid (Input VAT)

VAT paid on business purchases and expenses.

This is calculated from:

- Expense entries

- Supplier bills

- Cost of goods sold

Taxable Turnover

Total taxable revenue for the selected period.

Net VAT Refund / Credit

AutoGMS calculates:

Output VAT minus Input VAT

If Output VAT is higher, you owe VAT. If Input VAT is higher, you are due a refund or credit.

This automatic calculation reduces manual errors and simplifies reporting.

Tax Collected (Sales) Tab

This tab breaks down VAT charged to customers by VAT rate.

You can see:

- VAT Rate (e.g., 5%, 0% Exempt)

- Net Amount

- VAT Tax Amount

- Gross Amount

- Count of transactions

This helps you:

- Verify VAT rates applied correctly

- Ensure zero-rated transactions are separated

- Confirm total output VAT before filing

All values are calculated directly from issued invoices within the selected period.

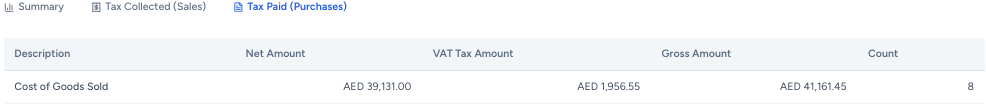

Tax Paid (Purchases) Tab

This tab shows VAT paid on business expenses.

You will see:

- Expense description or category

- Net Amount

- VAT Tax Amount

- Gross Amount

- Count of transactions

This section reflects VAT recorded in:

- Supplier bills

- Inventory purchases

- Operational expenses

Only expenses with VAT applied are included.

This ensures accurate input VAT tracking for reclaim purposes.

Tax Methodology

The VAT Report is generated based on:

Accrual Accounting Transactions are recorded when they occur, not when payment is received.

System-Based Tax Mapping VAT values are calculated based on the VAT rate assigned to invoices and expense categories.

Only transactions within the selected reporting period are included.

Exporting the VAT Report

You can export the VAT Report using the Export button in the top right corner.

This allows you to:

- Share with your accountant

- Submit to tax authorities

- Keep compliance records

Why the VAT Report Matters for Garages

Garages handle:

- Service labor

- Parts and materials

- Supplier purchases

- Operational expenses

Without structured VAT tracking, it becomes difficult to:

- File correctly

- Avoid penalties

- Monitor tax liabilities

AutoGMS centralizes VAT calculations so everything is linked to real transactions inside your system.

Conclusion

The VAT Report in AutoGMS provides a structured and reliable way to track tax collected and tax paid. With automatic calculations, categorized breakdowns, and export functionality, garage owners can stay compliant without complex spreadsheets.

Instead of manually reconciling invoices and expenses, AutoGMS keeps your VAT position clear and transparent at all times.

Frequently Asked Questions

Ready to Transform Your Workshop Operations?

Join 1000+ successful auto workshops using autoGMS to streamline operations, reduce no-shows, and boost revenue.

Related Articles

Continue reading with these related posts