How to Use the Aged Receivables Report in AutoGMS

Learn how to use the Aged Receivables Report in AutoGMS to track unpaid invoices, overdue customers, and improve cash collection.

The Aged Receivables Report in AutoGMS shows all outstanding customer invoices and organizes them based on how long they have been unpaid.

While:

- Profit & Loss shows profitability

- Cash Flow shows money movement

The Aged Receivables report shows who still owes you money and for how long.

This report is essential for:

- Monitoring unpaid invoices

- Managing overdue customers

- Protecting your cash flow

- Reducing bad debt risk

In this guide, you will learn how to read each tab and use the report effectively.

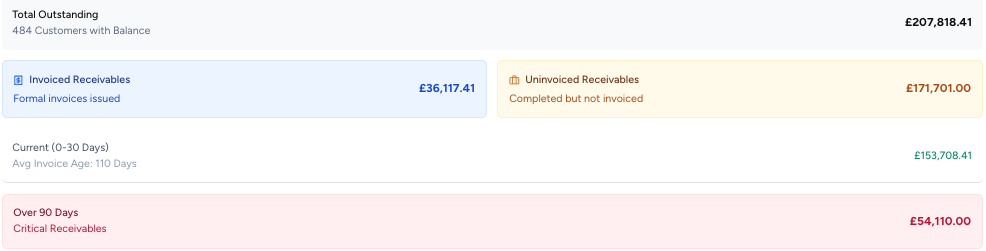

What the Aged Receivables Report Shows at a Glance (Summary Tab)

At the top of the report, you will see:

Total Outstanding

The total amount customers currently owe.

This includes:

- Invoiced receivables (formal invoices issued)

- Uninvoiced receivables (completed but not yet formally invoiced)

This distinction is important because uninvoiced work still impacts your cash flow.

You will also see:

- Current (0–30 Days)

- Over 90 Days (critical receivables)

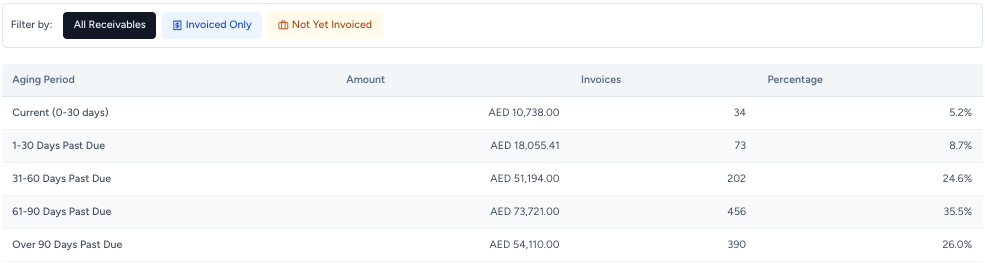

Understanding the Aging Analysis Tab

The Aging Analysis tab breaks receivables into time buckets:

- Current (0–30 days)

- 1–30 Days Past Due

- 31–60 Days Past Due

- 61–90 Days Past Due

- Over 90 Days Past Due

Each row shows:

- Total amount

- Number of invoices

- Percentage of total receivables

This helps you quickly identify payment risk.

If a large percentage falls under 60+ or 90+ days, immediate follow-up is recommended.

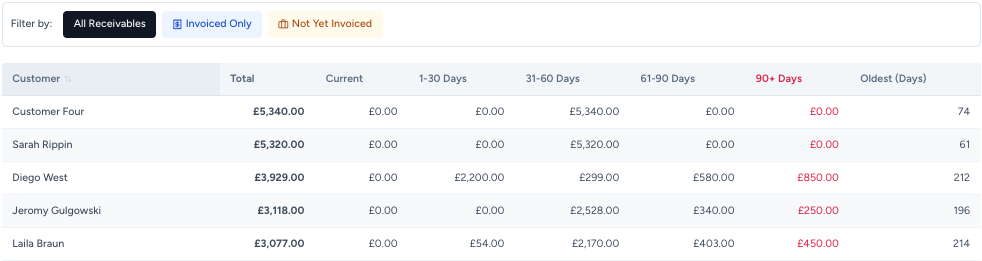

Understanding the By Customer Tab

The By Customer tab shows outstanding balances grouped by customer.

You can see:

- Total outstanding per customer

- Breakdown by aging bucket

- Oldest invoice age

This helps you identify:

- High-risk customers

- Long-standing unpaid invoices

- Clients requiring follow-up

This tab is especially useful for prioritizing collections.

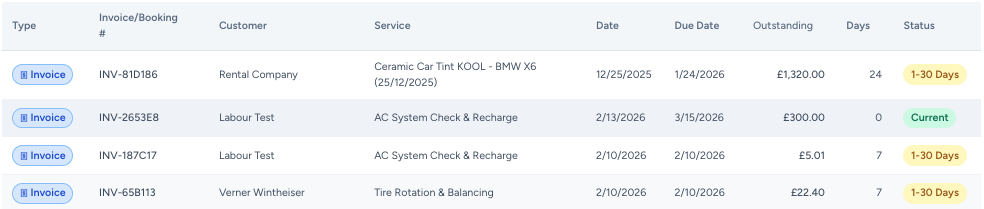

Understanding the Details Tab

The Details tab provides invoice-level information.

Each row shows:

- Invoice number

- Customer

- Service

- Invoice date

- Due date

- Outstanding amount

- Days overdue

- Status (Current, 1–30 Days, etc.)

This is the most detailed view and is used for:

- Direct customer follow-up

- Dispute resolution

- Collection tracking

Important Notes

- Aging is calculated based on the Invoice Date.

- The report includes both formal invoices and uninvoiced completed bookings.

- It is intended for internal management, not official statutory reporting.

Regular review improves cash collection performance.

When Should You Review Aged Receivables?

Recommended frequency:

- Weekly for active workshops

- Before month-end closing

- Before making large supplier payments

- When cash flow is tight

Strong receivables management directly improves liquidity.

Conclusion

The Aged Receivables Report gives you visibility into unpaid customer balances and overdue invoices.

If you want to improve cash flow, reduce payment delays, and maintain financial control, this is one of the most important reports to review regularly.

Frequently Asked Questions

Ready to Transform Your Workshop Operations?

Join 1000+ successful auto workshops using autoGMS to streamline operations, reduce no-shows, and boost revenue.

Related Articles

Continue reading with these related posts