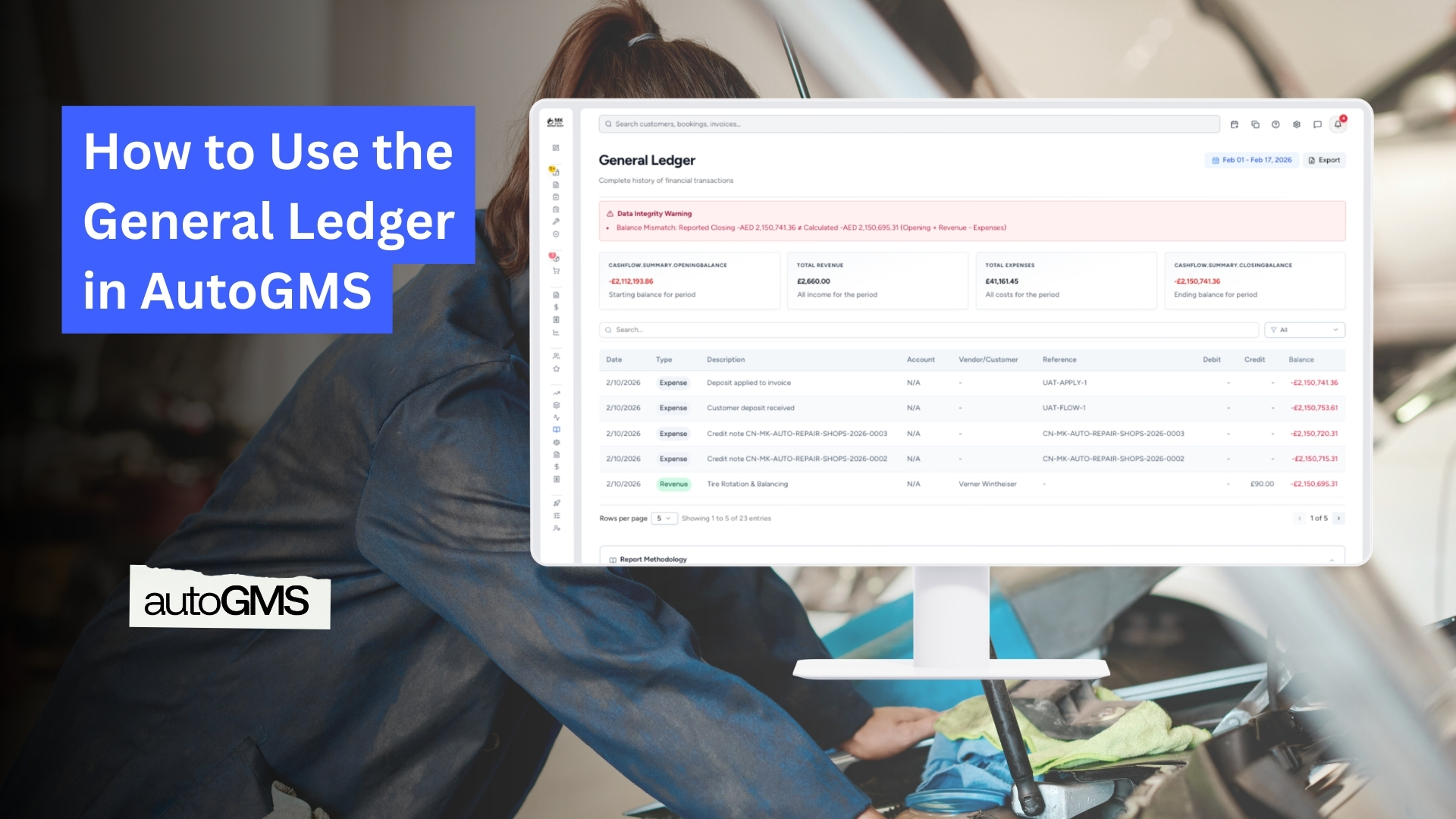

How to Use the General Ledger in AutoGMS

Learn how to use the General Ledger in AutoGMS to review transactions, track debits and credits, and reconcile financial balances accurately.

The General Ledger is the most detailed financial report in AutoGMS.

While:

- Profit & Loss shows performance

- Balance Sheet shows position

- Cash Flow shows liquidity

The General Ledger shows the complete history of all financial transactions recorded in the system.

It provides a transaction-by-transaction breakdown of:

- Revenue entries

- Expense entries

- Credits and debits

- Opening and closing balances

This report is essential for internal auditing, reconciliation, and deeper financial review.

In this guide, you will learn how to read and use the General Ledger inside AutoGMS.

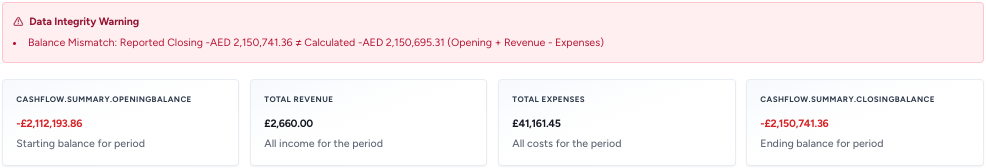

What the General Ledger Shows at a Glance

At the top of the report, you will see summary cards:

- Opening Balance – Starting balance for the selected period

- Total Revenue – All income recorded during the period

- Total Expenses – All costs recorded during the period

- Closing Balance – Ending balance for the selected period

If there is any mismatch between calculated and reported balances, a Data Integrity Warning will appear.

These summary figures help you quickly validate whether the numbers align.

Understanding the Transaction Table

Below the summary, you will see a detailed transaction table.

Each row represents a financial transaction and includes:

- Date

- Type (Revenue or Expense)

- Description

- Vendor/Customer

- Reference

- Debit

- Credit

- Running Balance

This section allows you to trace exactly how each transaction affected your balance.

Understanding Debit and Credit

AutoGMS follows a double-entry accounting system, meaning:

- Every transaction has a debit entry

- Every transaction has a credit entry

This ensures the accounting equation always remains balanced.

You do not need to manually manage debits and credits, but understanding them helps when reviewing discrepancies or reconciling with your accountant.

Data Integrity Warning Explained

If the system detects that:

Opening Balance + Revenue – Expenses ≠ Closing Balance

You may see a Balance Mismatch Warning.

This usually indicates:

- Manual adjustments

- Backdated entries

- Incomplete transactions

Review the transaction list carefully if this appears.

When Should You Use the General Ledger?

The General Ledger is useful when you need:

- Detailed transaction audits

- Month-end reconciliation

- Accountant review

- Investigation of discrepancies

For daily management, Profit & Loss and Cash Flow may be enough. For full transparency, use the General Ledger.

Conclusion

The General Ledger is the most detailed financial report in AutoGMS.

It provides complete transparency over every recorded transaction and ensures your financial data remains traceable and balanced.

If you need to verify numbers, investigate differences, or prepare for accountant review, this is the report to use.

Frequently Asked Questions

Ready to Transform Your Workshop Operations?

Join 1000+ successful auto workshops using autoGMS to streamline operations, reduce no-shows, and boost revenue.

Related Articles

Continue reading with these related posts