How to Use the Cash Flow Statement in AutoGMS

Learn how to use the Cash Flow Statement in AutoGMS to track cash in, cash out, operating activities, and equipment investments.

While the Profit & Loss report shows profitability and the Balance Sheet shows financial position, the Cash Flow Statement shows something equally important:

How cash actually moves in and out of your garage.

A business can be profitable on paper but still struggle with cash. The Cash Flow report in AutoGMS helps you monitor:

- Cash received from customers

- Cash paid to suppliers

- Cash paid for operating expenses

- Cash used for equipment or investments

This report gives you real visibility into your workshop’s liquidity and day-to-day financial health.

What the Cash Flow Statement Shows at a Glance

At the top of the report, you will see:

Net Cash Flow

This shows the total cash movement during the selected period.

If positive → More cash came in than went out. If negative → More cash went out than came in.

Below that, the report is divided into two main categories:

- Operating Activities

- Investing Activities

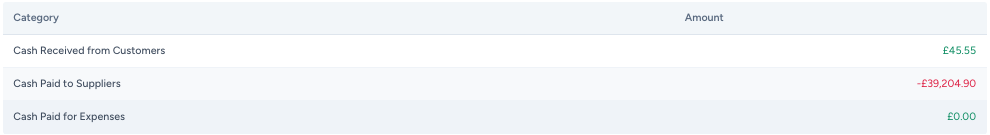

Understanding Operating Activities

Operating Activities show the cash movement from your daily garage operations.

This typically includes:

Cash Received from Customers

Total payments collected from bookings within the selected period. This includes partial payments.

Cash Paid to Suppliers

Payments made for parts categorized as Cost of Goods Sold (COGS).

Cash Paid for Expenses

Payments made for operational expenses such as rent, utilities, labor, and subscriptions. This excludes COGS and equipment purchases.

At the bottom, you will see:

Net Cash from Operating

This shows whether your daily operations are generating or consuming cash.

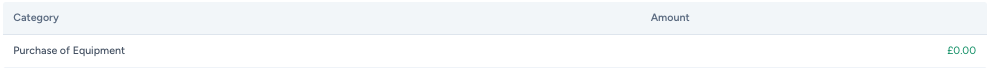

Understanding Investing Activities

Investing Activities focus on long-term purchases.

Purchase of Equipment

This includes expenses categorized as Equipment or Assets.

These are capital expenditures (CapEx) rather than daily operational costs.

If this number is negative, it means you invested in equipment during that period.

Why the Cash Flow Statement Matters

Cash flow determines whether you can:

- Pay suppliers on time

- Cover operating expenses

- Invest in new equipment

- Avoid cash shortages

Even if your Profit & Loss report shows profit, poor cash flow can create financial stress.

The Cash Flow report helps you monitor liquidity and make smarter financial decisions.

Frequently Asked Questions

Ready to Transform Your Workshop Operations?

Join 1000+ successful auto workshops using autoGMS to streamline operations, reduce no-shows, and boost revenue.

Related Articles

Continue reading with these related posts