How to Use the Aged Payables Report in AutoGMS

Learn how to use the Aged Payables Report in AutoGMS to track vendor bills, overdue payments, and manage supplier obligations effectively.

The Aged Payables Report in AutoGMS shows all outstanding vendor bills and organizes them based on how long they have been unpaid.

While the Aged Receivables report shows who owes you money, the Aged Payables report shows who you owe money to.

This report helps you:

- Monitor unpaid supplier bills

- Avoid late payment penalties

- Maintain strong vendor relationships

- Manage outgoing cash flow

In this guide, you will learn how to read each section of the Aged Payables report and use it effectively.

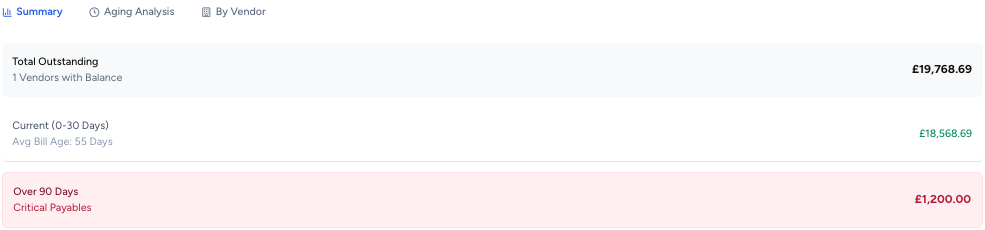

What the Aged Payables Report Shows at a Glance (Summary Tab)

The Summary tab gives you a quick overview of your vendor obligations.

You will see:

Total Outstanding

The total amount you currently owe to vendors.

You will also see aging highlights such as:

- Current (0–30 Days)

- Over 90 Days (Critical Payables)

If a large portion of payables falls into the 60+ or 90+ days category, immediate attention may be required.

This section helps you quickly assess payment risk.Understanding the Aging Analysis Tab

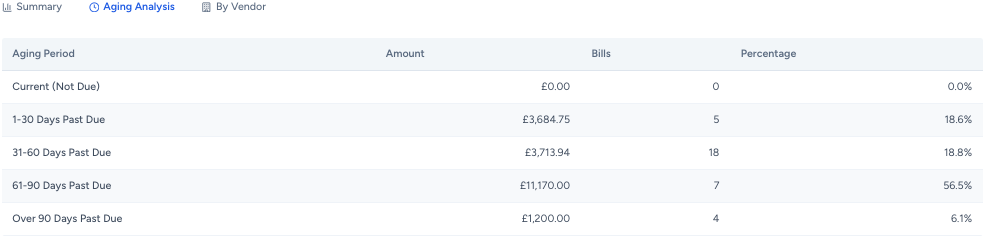

The Aging Analysis tab groups unpaid vendor bills into time buckets:

- Current (Not Due)

- 1–30 Days Past Due

- 31–60 Days Past Due

- 61–90 Days Past Due

- Over 90 Days Past Due

Each row displays:

- Total amount

- Number of bills

- Percentage of total payables

This allows you to understand how overdue your supplier payments are.

If most of your payables are within the current or 1–30 day range, your payment management is healthy.

Understanding the By Vendor Tab

The By Vendor tab groups outstanding balances by supplier.

For each vendor, you can see:

- Total amount owed

- Breakdown by aging bucket

- Oldest outstanding bill (in days)

This helps you:

- Prioritize vendor payments

- Identify suppliers at risk of delayed payments

- Manage negotiation or payment scheduling

This view is useful when planning outgoing payments.

Important Notes

- Aging is calculated based on the Bill Date.

- The report reflects unpaid vendor expenses recorded in the system.

- It is designed for internal management use.

Regular review prevents supplier disputes and protects your credit standing.

When Should You Review Aged Payables?

Recommended frequency:

- Weekly for active workshops

- Before processing supplier payments

- During month-end review

- When managing cash flow planning

Proper payable management ensures smooth operations.

Conclusion

The Aged Payables Report gives you visibility into outstanding vendor bills and overdue supplier payments.

Reviewing this report regularly helps you:

- Stay organized

- Avoid late fees

- Protect supplier relationships

- Maintain better cash flow control

Together with Aged Receivables, it gives you full control over incoming and outgoing obligations.

Frequently Asked Questions

Ready to Transform Your Workshop Operations?

Join 1000+ successful auto workshops using autoGMS to streamline operations, reduce no-shows, and boost revenue.

Related Articles

Continue reading with these related posts